PickDifferently!

Nemo is YOUR Captain who deep-dives into League statistics – so you don’t have to!

Nemo.gg is here to remove some of the stress from your team and avoid toxic starts to games. Nemo.gg crunches heavy calculations for you – to figure out – which of your best champions synergize with teammates’ champions the most.

Join the beta today!

Sign up to downloadPick, Ban & Play Differently

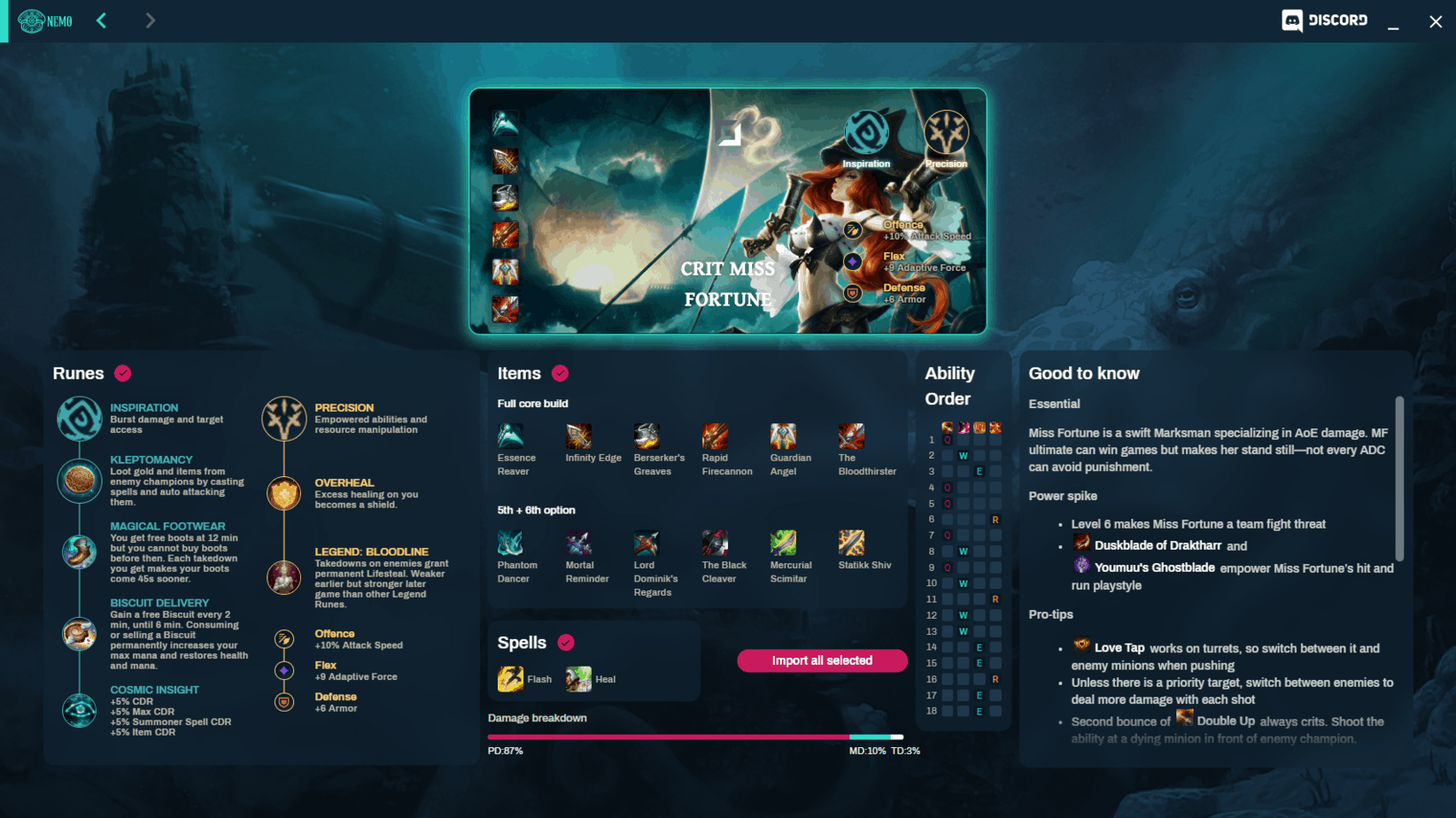

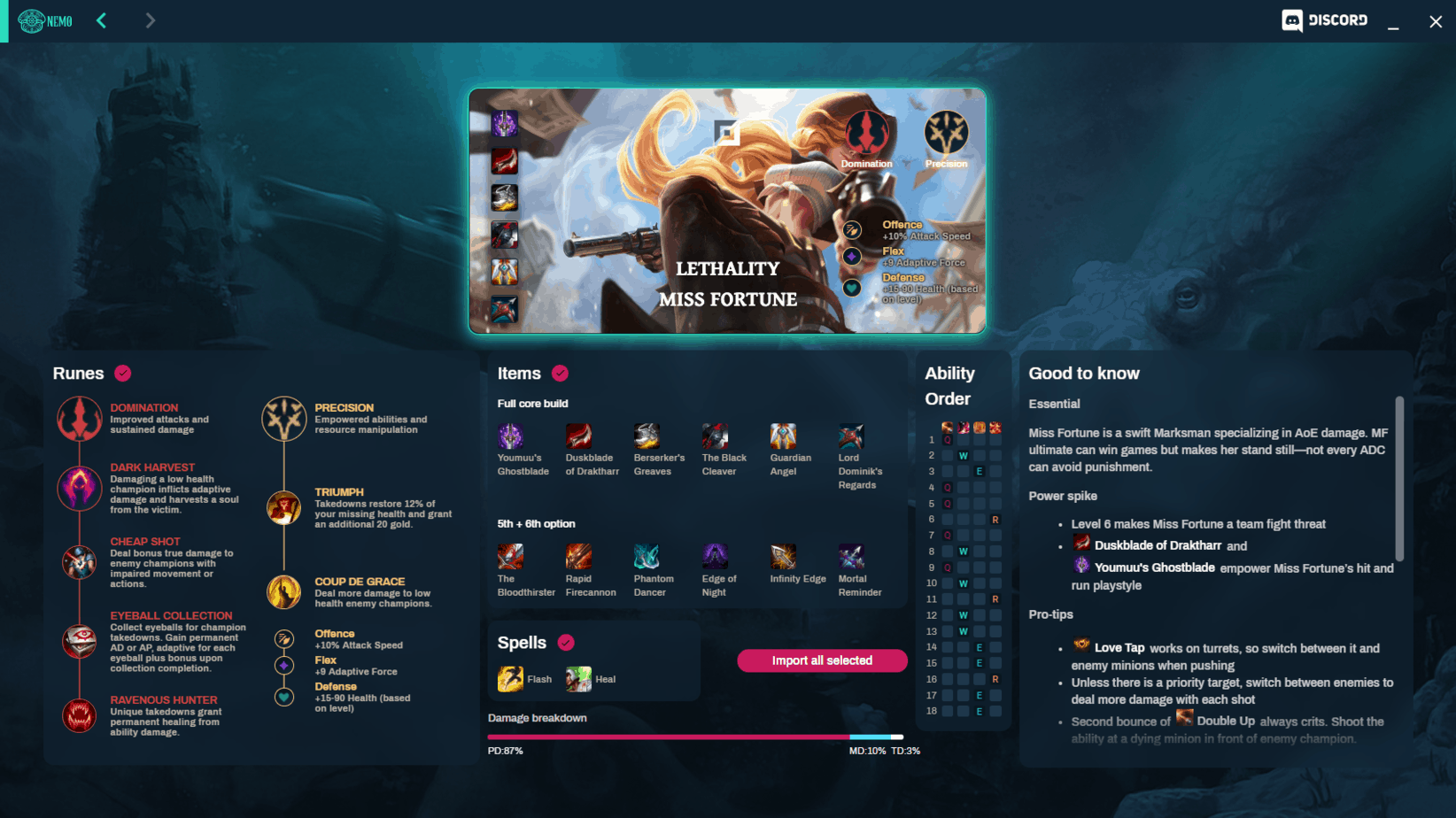

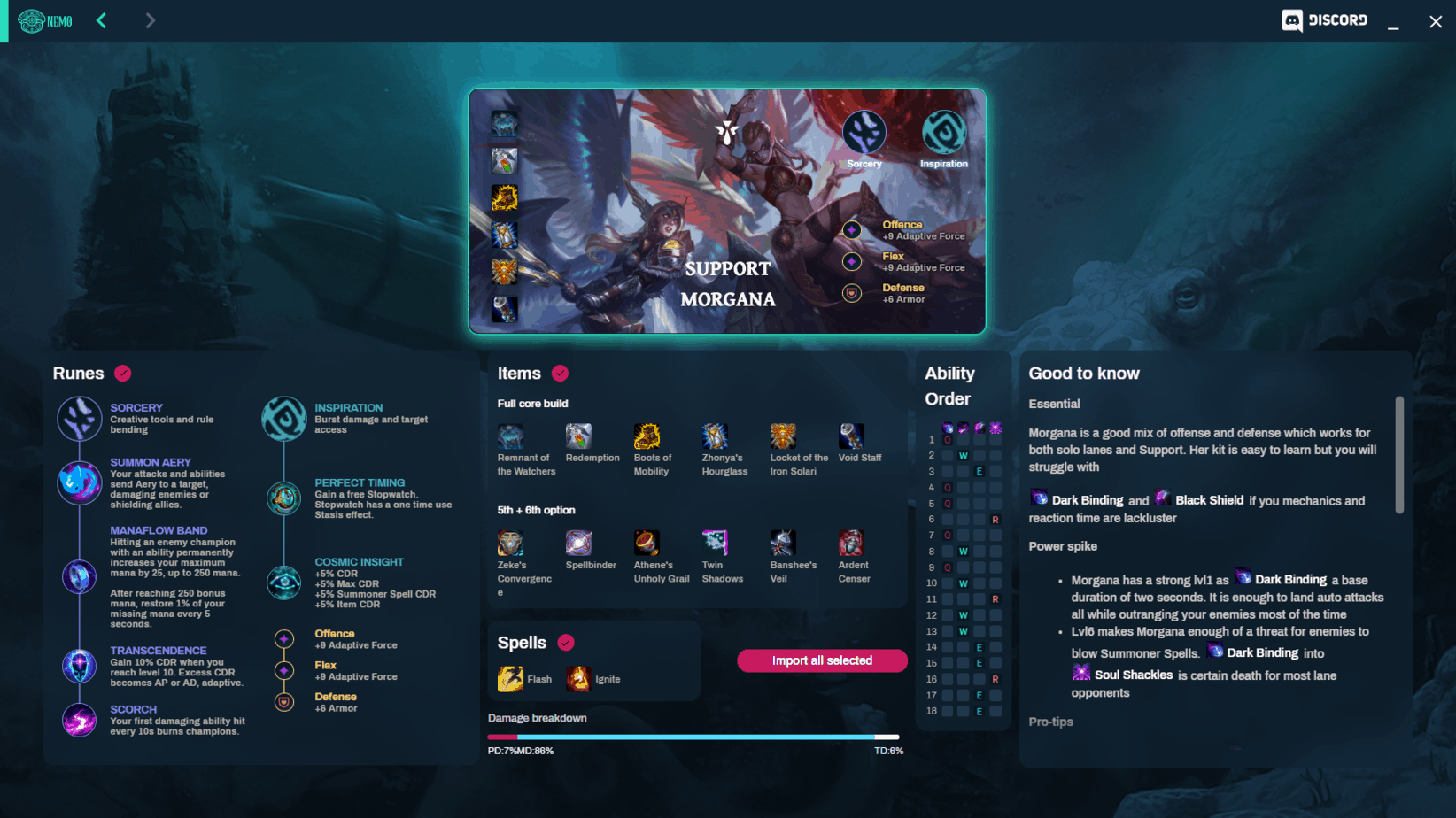

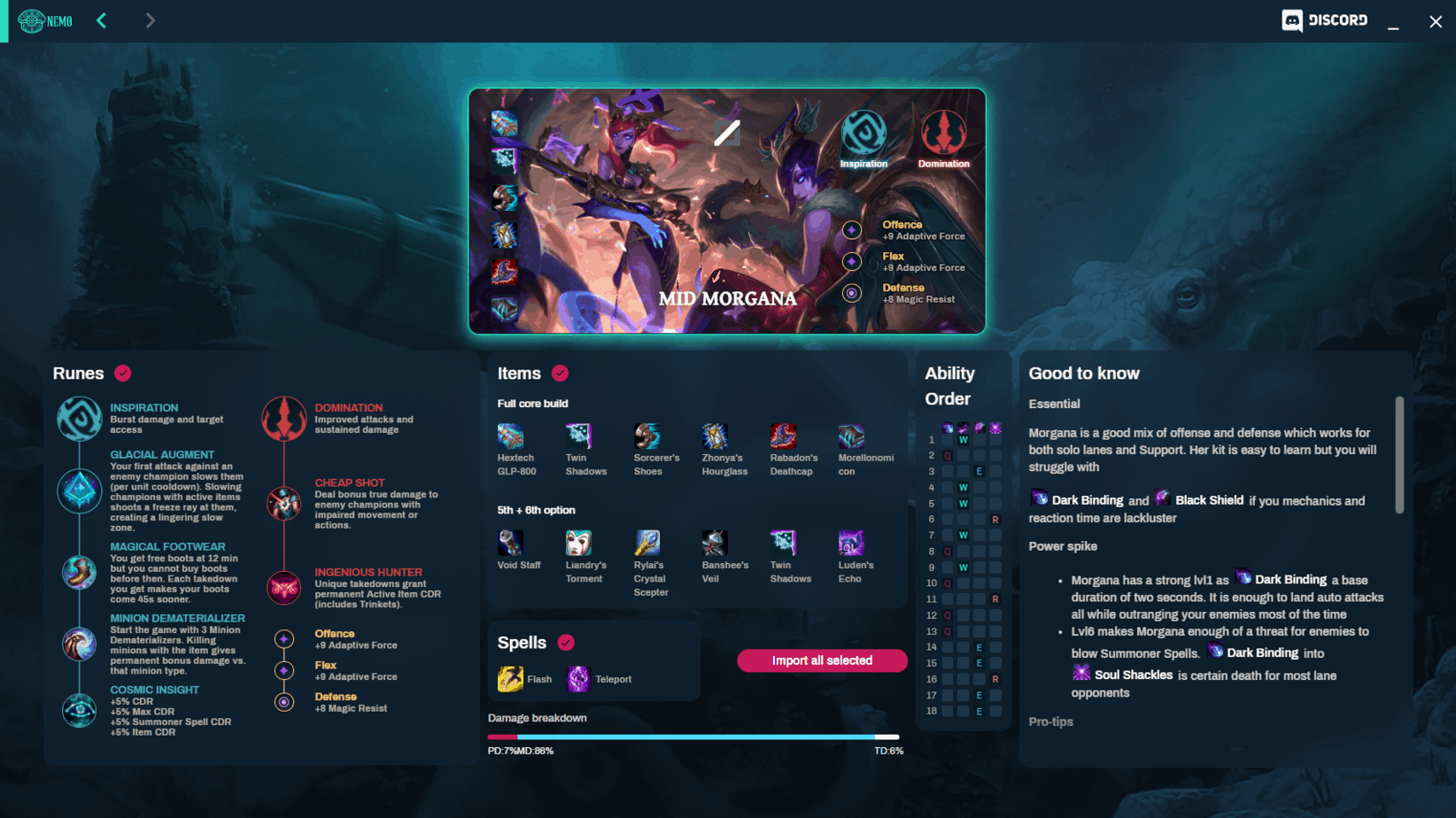

All the builds in one app

Our builds fit every style and position

Features

1

Epic builds

Nemo gives you a build + runes that lets you play

Speedy Annie

or

On-Hit Urgot . Play your favorite champion differently. Keep League Fresh!

Complements of our team of League experts that put the most interesting, fun, dynamic and epic builds together. (These guys spend waaay too many hours on Twitch and the Rift.)

On-Hit Urgot . Play your favorite champion differently. Keep League Fresh!

Complements of our team of League experts that put the most interesting, fun, dynamic and epic builds together. (These guys spend waaay too many hours on Twitch and the Rift.)

2

L33t teamwork

That feeling in champ-select where you just know that you’re going to win? Nemo is your captain who matches you and your teammates’ best champions!

Complements of our tireless / relentless / evercurious machine learning algorithms that sit on expensive Amazon servers giving you the very best advanced statistical modeling has to offer in 2019!

3

Banning enemy champs

Banning for a teammate can be more impactful than helping your own lane.

It’s simple math really, right? You just need to process a few hundred million permutations during the ban phase and you can do it yourself... Meh, forget about it! Let our robots do that for you!

4

Counter your lane opponent perfectly!

Why not switch from one main to another if the second option also negates your rival?

Our evil robot overlords (sitting in our basement now) has access to supercomputers, and they’ve calculated which of your champions counter the enemy the hardest!

Our evil robot overlords (sitting in our basement now) has access to supercomputers, and they’ve calculated which of your champions counter the enemy the hardest!